Ce a spus la BNR Viscount Etienne Davignon, seful Bilderberg, grupul in care se discuta soarta lumii

Autor: Bancherul.ro

Autor: Bancherul.ro

2011-10-15 17:10

Grupul Bilderberg este numele unei conferinte anuale la care participa politicieni (sefi de stat si de guverne, ministri, ambasadori) si economisti (sefii marilor banci centrale si comerciale si ai marilor corporatii).

Prima conferinta a avut loc la Hotel de Bilderberg, lângă Arnhem în Olanda, in 1954, de unde si numele conferintei, fiind initiata de un grup de persoane, printre care politicianul polonez Joseph Retinger, îngrijorati de creşterea anti-americanismului în Europa de Vest.

Motiv pentru care acestia s-au gandit la organizarea unei conferinte internationale la care sa se adune lideri din ţările europene şi Statele Unite, cu scopul de a promova Atlanticismul, adica o mai bună înţelegere între culturile din Statele Unite şi Europa de Vest si promovarea cooperarii pe probleme politice, economice, şi de apărare.

Retinger l-a abordat pe Prinţul Bernhard al Olandei, care a fost de acord să promoveze ideea, împreună cu fostul prim-ministru belgian Paul Van Zeelanda si şeful Unilever, olandezul Paul Rijkens. Bernhard la rândul său, l-a contactat pe Walter Bedell Smith, seful CIA, care i-a prezentat propunerea consilierului lui Eisenhower, Charles Douglas Jackson. Ca urmare, 50 de delegaţi din 11 ţări din Europa de Vest au participat la prima conferinţă, împreună cu 11 americani.

O alta conferinta de acest gen, Comisia Trilaterala, la care au participat si Mugur Isarescu si Mihai Tanasescu (singurii romani participanti), a fost infiintata mai tarziu, in 1972 de catre David Rockefeller, dupa ce Grupul Bilderberg a refuzat sa includa si Japonia.

Mugur Isarescu a participat si la o alta conferinta anuala cu iz secret si conspirativ, despre care se spune ca pune la cale soarta omenirii, si anume cea din statiunea montana Jackson Hole din statul american Wyoming, organizata de Federal Reserve Bank of Kansas si unde, in august 1990, Isarescu anunta noua politica economica si financiara a Romaniei dupa caderea dictaturii.

Revenind la ceea ce s-a intamplat vineri la BNR, iata cum a decurs conferinta desfasurata, fireste, in limba engleza, din care reproducem declaratiile, cat mai fidel cu putinta, cu toate ca BNR nu a asigurat conditii propice pentru ziaristi, carora nu le-a fost permisa prezenta in sala in care s-a desfasurat conferinta, astfel incat acestia au fost nevoiti sa urmareasca discursurile la un mic televizor dintr-o sala alaturata, al carui sunet a fost greu de sesizat. Mai ales ca seful Bilderberg, un belgian, a avut un discurs in limba engleza destul de greu de urmarit, cu fraze sub forma de suvoaie, fara prea multe intonatii. Semnele de intrebare, de exclamatie, punctele si paragrafele au fost greu de identificat, astfel incat coerenta discursului a avut de suferit. Presedintele conferintei Bilderberg are, probabil, alte calitati, insa nu este un bun orator, nici macar un bun conferentiar.

(Am fost curios sa vad ce a prezentat una dintre televiziunile care a organizat evenimentul si care a avut exclusivitate la conferinta si astfel am aflat ca vicecontele Davignon a venit la Bucuresti cu unghiile murdar si cu talpa pantofilor tocita. Nu conteaza ce a spus.)

Discursul lui Mugur Isarescu

Mugur Isarescu: "It is a great pleasure for the National Bank of Romania and an honour for me to host...provoking and substantion discutions about the challenges currently facing world and particulary Europe... Tonight we have the privilege of welcome umong us two of the greatest mindes in the world today. They are both leaders of event shaping and agenda setting organizations that influence the course of history by the power of the ideas they have and gender.

It is my pleasure tonight to present you Viscount Etienne Davignon (foto), chairman of the Bilderberg Group. The proud native of Belgium, he was foreign affair ministry of his country, vice-president of the European Commision and the first president of the International Energy Agency. With the keen and intimate knowlege of the spectacular institutional framework which is the European Union, Viscount Davignon has been uphailing in having the (visility) and presence of mind to identify both its strengths and weaknesses. Viscount, allow me to salute you and kindly thank you for joining us tonight...

I'm also pleased to welcome the respected journalist Emil Hurezeanu, who will be moderating tonight disccutions.. Mr. Hurezeanu was a voice of hope through Radio Free Europe. During the last few years, he has given us the benefit of his inside regarding Romania...Distinguised guests, let me assure you that tonight we have an audiance of highest caliber. It is no exageration to note that some of the Romanian most important thinkers and decision makers are gathered here tonight. (Among the guests stood out Ion Iliescu, Nicolae Vacaroiu, Adrian Nastase, Daniel Daianu, Radu Ghetea, Rasvan Radu and almost the entire NBR government commitee n.r.).

Emil Hurezeanu, the moderater

Emil Hurezeanu: "We'll have a first hour of questions, my questions, on the floor, to these gentlemen, a q&a session and then the last half an hour will be dedicated to you (the public), we'll open the floor to you, ladies and gentlement. So let's start. The perspective of the institutional redefining of the European Union in terms of an increased level of integration by.. the establishment of the ministry of finance of the EU over European treasury, initially only for the Eurozone contries. Well, three sub-questions: how deep should this reform be, then how advsible is for the member states that the EU finance ministers jet...combines, joint the fiscal policies and de (unitory) fee and tax policy? Sirs, it's over to you. Viscunt Davignon.

Ce a spus seful Bilderberg la BNR

Viscount Etienne Davignon: "Allow me first to tell the governer that I'll use a quotation of... who said that "nothing is nicer than exagerated friends. So you enjoy it but don't believe it". I can assure you I don't believe it.

The question you've asked is... do we need a redefining of our institutional setup to solve the problemes we are confronted with today? And the answer is clearly "no". The capacity to act if the will to act exists, exists inside the present structures. Is it strong enough to guarantee the future? That is why we are thinking of modifications and changes, but I think you would be misguided to believe that the institutionals framework does not allow to take the indispensable decissions related to the present crisis as we have it.

The present crisis is very simply to define: is that now someone mistakes are considerd by markets exactly in the same situation as by debt investors. The risk of the sovereigns debt is comparable to the risk of an individual or an institution? Yes, we are ready to lend you money but we want to know what are the securities that we get. This had not exist before. Before, banks lined up to lend to sovereign states regarded it was considered as a no risk situation. That has changed. The first country hat saw the change is the crisis which came up in Greece.

All the most difficult from the public opinion point of view is that part of what was discovered was not disclosed. And of course, when you are confronted with de problems and when you call all the solidarity, which is the consecance of carring a joint currency, you do not like to feel cheated. Here again, the responsabilly is not a case at all.

When the European Commision requested for the auditors to go and check of the accouns, a majority of countries refused to give that power to the European Commision because they did't want the auditors to put their nose in their affaires. Major mistake.

Secondly, since the start of the Monetary Union, a number of voices and important voices were saying if you don't have the key which is economic and monetary union, if you don't have a higher degree of coherence of the economical and monetary policy, will run into difficulty. And here again, as seen inside the European Union, the Stability Pact, which (made it a) debate into the decision to have a monetary union, suddenly Germany and France were no longer complient with the obligations of stability pact. They said: "whether you put your house as a collateral it's OK". Major mistake, major mistake of the European Commision of not going to the Court of Justice to get this because that is their responsability and so as everything was going well, but it haven't.

The third element which was not confirmed was the question was raised very clearly what happens if one element does not follow a proper, an ortodox fiscal policy. And the answer was the markets will act, the cost of borrowing will go up...but the markets saw nothing. The wrong thing was that once you have a common currency, whatever everybody did in particular did nothing it all was people did colectivly with market and so there was a sanction which was I think generaly believed to be the sanction of the markets if people did not behave, did not happen.

The three elements of getting out of the crisis

The only common sense attitude is: It's impossible not to make mistakes, it is indispensable not to make the same mistakes... And so we come to the three elements of getting out of the crisis.

Nr.1: reinforsing the obligation of fiscal orthodoxy... which the governments decided on, that the European Parliament has voted up, so it becomes an obligation with sanctions. Not only the sanction of the market, the sanction of the sistem. It is enough, it is not enough? To fight all is difficult but it is a recognision of the mistakes we made.

The second question is the Greek question: if a government guarancy is a guarancy of everyone and you can't be interested in one country having this guranty and running in difficulty. So what happens here is that all three have to realise that there has to be an end to the Greek story... and the necesarry steps we take them which do not creat a former default of Greece in the relace with sovereign debt.

Why is this something that we have to avoid? Not because perse it is something which is the money, but because the concern is if the common reaction to an individual problem is not solved why would not that happen to another country?

And if we can live with the cost of the Greek crisis it is clear that neither we nor the rest of the world because of the consequences

in Europe can live with the crisis of a major economy inside the European Union.

So we have to get that right we now have a fund which has been approved by 27 countries and in terms of the capacity to act we have to act individualy because soverenity was not handed over to the European Union and we did that with ratification by 27 Parliaments in three months. In historically and politicaly terms that is lighty speed. So it's posible.

And the third element is that we have to show that we are concerned about the necesary measures we have to take so that (cause) is restored. If we don't restore...we don't have the proper balance in between orthodoxy and if we don't have it we have nothing but if we only have orthodoxy we don't have a future.

So these are the key things that we have to do. Once we stand up then we have to sit down and see how we can do things but I don't belive one minute in the idea of a EU finance minister. Not one second.

It is completley contradictory to the concept that is: not a state or nation dissapear at the request by the European Union that happen like this or that. We are not trying to gear the United States of Europe...but in the time framing which we have, what are we doing is we are sharing soverignity. And by doind this we decide that there are a number of issues, none of us individually can decide and we have to decide corectly.

And of course we will have to decide by a majority of votes. There is a kind of a new look at the situations and you look at an institution like the IMF which is not an highly integrated institution...

Comentarii

Adauga un comentariu

Adauga un comentariu folosind contul de Facebook

Alte stiri din categoria: Stirea Zilei

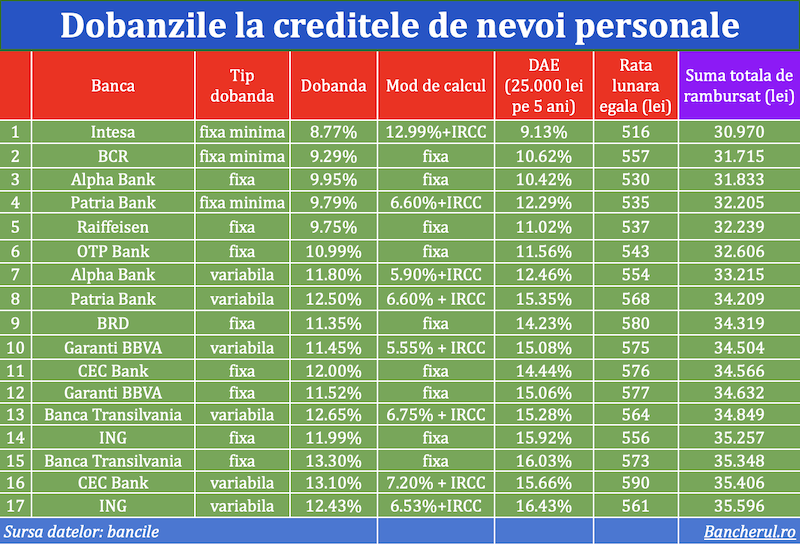

Ce dobanzi au bancile la creditele de nevoi personale?

Dobanzile practicate de cele mai multe banci pentru creditele de nevoi personale destinate consumului nu mai sunt stabilite la niveluri standard ci sunt personalizate, in functie de mai multi factori, precum incasarea veniturilor in contul bancii sau istoricul de detalii

Topul creditelor ipotecare cu cele mai mici dobanzi fixe in primii 3-10 ani

Dobanzile fixe in primii 3-10 ani pentru un credit ipotecar variaza intre 5,75% si 9,90%, in functie de banca si de perioada cu dobanda nemodificata, conform ofertelor celor mai importante 10 banci. Dobanzile luate in calcul sunt cele standard, fara alte detalii

Cum raspunde ANPC la o reclamatie despre o frauda online: cu cuvintele bancii

Clientul unei banci (Unicredit) a fost fraudat online cu 25.000 de lei cu o asa-zisa investitie in actiuni pe site-ul Rominvest. (Atentie! Acest site functioneaza si in prezent, la acest link, https://dimensionaldreamscape.cam, dupa mai bine de o luna de la detalii

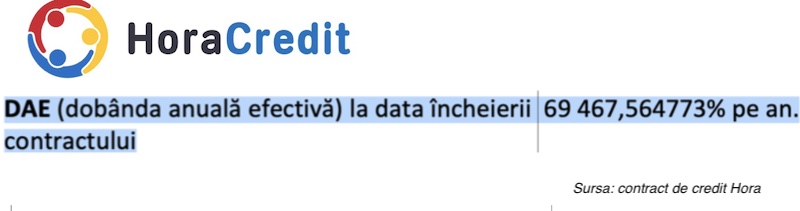

Dobanzile la creditele online ale IFN-urilor, plafonate prin lege la 365% pe an, fata de 70.000% cat erau pana acum

Parlamentul a adoptat o lege prin care dobanzile (DAE) la creditele online acordate de IFN-uri (Institutii Financiare Nebancare) sunt plafonate la 1% pe zi (365% pe an) in cazul imprumuturilor de maxim 5.000 de lei, 0,8% pe zi (292% pe an) la cele de pana la 10.000 de lei si 0,6% pe detalii

- Revolut isi obliga clientii sa plateasca credite facute prin fraude online

- Nimeni nu poate opri Facebook sa faca profit din promovarea fraudelor online

- Cum poti fi inselat cu actualizarea datelor in aplicatia George BCR

- Linia de credit este noul instrument de tortura al IFN-urilor

- Este normal ca IFN-urile sa nu-si ajute clientii care nu mai pot plati creditele si sa-i execute silit?

- Topul bancilor cu cele mai bune dobanzi la depozitele in lei

- In atentia BNR: mama mea de 74 de ani a facut 10 credite la IFN-uri si are de platit dobanzi de 4.000 de lei din pensia de 2.300 de lei!

- Profitul bancilor atinge un nou record, de 13,7 miliarde lei, in 2023

- Am vazut 17 clipuri false cu Mugur Isarescu, pe Facebook, intr-o singura zi

- De ce nu opreste Facebook videoclipurile trucate cu Mugur Isarescu?

Criza COVID-19

- In majoritatea unitatilor BRD se poate intra fara certificat verde

- La BCR se poate intra fara certificat verde

- Firmele, obligate sa dea zile libere parintilor care stau cu copiii in timpul pandemiei de coronavirus

- CEC Bank: accesul in banca se face fara certificat verde

- Cum se amana ratele la creditele Garanti BBVA

Topuri Banci

- Topul bancilor dupa active si cota de piata in perioada 2022-2015

- Topul bancilor cu cele mai mici dobanzi la creditele de nevoi personale

- Topul bancilor la active in 2019

- Topul celor mai mari banci din Romania dupa valoarea activelor in 2018

- Topul bancilor dupa active in 2017

Asociatia Romana a Bancilor (ARB)

- Băncile din România nu au majorat comisioanele aferente operațiunilor în numerar

- Concurs de educatie financiara pentru elevi, cu premii in bani

- Creditele acordate de banci au crescut cu 14% in 2022

- Romanii stiu educatie financiara de nota 7

- Gradul de incluziune financiara in Romania a ajuns la aproape 70%

ROBOR

- ROBOR: ce este, cum se calculeaza, ce il influenteaza, explicat de Asociatia Pietelor Financiare

- ROBOR a scazut la 1,59%, dupa ce BNR a redus dobanda la 1,25%

- Dobanzile variabile la creditele noi in lei nu scad, pentru ca IRCC ramane aproape neschimbat, la 2,4%, desi ROBOR s-a micsorat cu un punct, la 2,2%

- IRCC, indicele de dobanda pentru creditele in lei ale persoanelor fizice, a scazut la 1,75%, dar nu va avea efecte imediate pe piata creditarii

- Istoricul ROBOR la 3 luni, in perioada 01.08.1995 - 31.12.2019

Taxa bancara

- Normele metodologice pentru aplicarea taxei bancare, publicate de Ministerul Finantelor

- Noul ROBOR se va aplica automat la creditele noi si prin refinantare la cele in derulare

- Taxa bancara ar putea fi redusa de la 1,2% la 0,4% la bancile mari si 0,2% la cele mici, insa bancherii avertizeaza ca indiferent de nivelul acesteia, intermedierea financiara va scadea iar dobanzile vor creste

- Raiffeisen anunta ca activitatea bancii a incetinit substantial din cauza taxei bancare; strategia va fi reevaluata, nu vor mai fi acordate credite cu dobanzi mici

- Tariceanu anunta un acord de principiu privind taxa bancara: ROBOR-ul ar putea fi inlocuit cu marja de dobanda a bancilor

Statistici BNR

- Deficitul contului curent după primele două luni, mai mare cu 25%

- Deficitul contului curent, -0,39% din PIB după prima lună a anului

- Deficitul contului curent, redus cu 17%

- Inflatia a încheiat anul 2023 la 6,61%, semnificativ sub prognoza oficială

- Deficitul contului curent, redus cu o cincime după primele zece luni ale anului

Legislatie

- Legea nr. 311/2015 privind schemele de garantare a depozitelor şi Fondul de garantare a depozitelor bancare

- Rambursarea anticipata a unui credit, conform OUG 50/2010

- OUG nr.21 din 1992 privind protectia consumatorului, actualizata

- Legea nr. 190 din 1999 privind creditul ipotecar pentru investiții imobiliare

- Reguli privind stabilirea ratelor de referinţă ROBID şi ROBOR

Lege plafonare dobanzi credite

- BNR propune Parlamentului plafonarea dobanzilor la creditele bancilor intre 1,5 si 4 ori peste DAE medie, in functie de tipul creditului; in cazul IFN-urilor, plafonarea dobanzilor nu se justifica

- Legile privind plafonarea dobanzilor la credite si a datoriilor preluate de firmele de recuperare se discuta in Parlament (actualizat)

- Legea privind plafonarea dobanzilor la credite nu a fost inclusa pe ordinea de zi a comisiilor din Camera Deputatilor

- Senatorul Zamfir, despre plafonarea dobanzilor la credite: numai bou-i consecvent!

- Parlamentul dezbate marti legile de plafonare a dobanzilor la credite si a datoriilor cesionate de banci firmelor de recuperare (actualizat)

Anunturi banci

- Bancile comunica automat cu ANAF situatia popririlor

- BRD bate recordul la credite de consum, in ciuda dobanzilor mari, si obtine un profit ridicat

- CEC Bank a preluat Fondul de Garantare a Creditului Rural

- BCR aproba credite online prin aplicatia George, dar contractele se semneaza la banca

- Aplicatia Eximbank, indisponibila temporar

Analize economice

- Rezultatul economic pe 2023, tot +2,1% dar cu 7 miliarde lei mai mare

- România - prima în UE la inflație, prin efect de bază

- Deficitul comercial lunar a revenit peste cota de 2 miliarde euro

- România, 78% din media UE la PIB/locuitor în 2023

- România - prima în UE la inflație, prin efect de bază

Ministerul Finantelor

- Deficitul bugetar, -2,06% din PIB pe primul trimestru al anului

- Datoria publică, imediat sub pragul de 50% din PIB la începutul anului 2024

- Deficitul bugetar, deja -1,67% din PIB după primele două luni

- Datoria publică, sub pragul de 50% din PIB la finele anului 2023

- Deficitul bugetar, din ce în ce mai mare la început de an

Biroul de Credit

- FUNDAMENTAREA LEGALITATII PRELUCRARII DATELOR PERSONALE IN SISTEMUL BIROULUI DE CREDIT

- BCR: prelucrarea datelor personale la Biroul de Credit

- Care banci si IFN-uri raporteaza clientii la Biroul de Credit

- Ce trebuie sa stim despre Biroul de Credit

- Care este procedura BCR de raportare a clientilor la Biroul de Credit

Procese

- Un client Credius obtine in justitie anularea creditului, din cauza dobanzii prea mari

- Hotararea judecatoriei prin care Aedificium, fosta Raiffeisen Banca pentru Locuinte, si statul sunt obligati sa achite unui client prima de stat

- Decizia Curtii de Apel Bucuresti in procesul dintre Raiffeisen Banca pentru Locuinte si Curtea de Conturi

- Vodafone, obligata de judecatori sa despagubeasca un abonat caruia a refuzat sa-i repare un telefon stricat sau sa-i dea banii inapoi (decizia instantei)

- Taxa de reziliere a abonamentului Vodafone inainte de termen este ilegala (decizia definitiva a judecatorilor)

Stiri economice

- România, total în afara țărilor similare cu deficitul de cont curent

- Producția industrială pe februarie, cu aproape 7% sub cea din urmă cu cinci ani

- Inflația anuală a revenit la nivelul de la finele anului anterior

- Pensia reală de asigurări sociale de stat a crescut anul trecut cu 2,9%

- Producția de cereale boabe pe 2023, cu o zecime mai mare față de anul precedent

Statistici

- Care este valoarea salariului minim brut si net pe economie in 2024?

- Cat va fi salariul brut si net in Romania in 2024, 2025, 2026 si 2027, conform prognozei oficiale

- România, pe ultimul loc în UE la evoluția productivității muncii în agricultură

- INS: Veniturile romanilor au crescut anul trecut cu 10%. Banii de mancare, redistribuiti cu precadere spre locuinta, transport si haine

- Inflatia anuala - 13,76% in aprilie 2022 si va ramane cu doua cifre pana la mijlocul anului viitor

FNGCIMM

- Programul IMM Invest continua si in 2021

- Garantiile de stat pentru credite acordate de FNGCIMM au crescut cu 185% in 2020

- Programul IMM invest se prelungeste pana in 30 iunie 2021

- Firmele pot obtine credite bancare garantate si subventionate de stat, pe baza facturilor (factoring), prin programul IMM Factor

- Programul IMM Leasing va fi operational in perioada urmatoare, anunta FNGCIMM

Calculator de credite

- ROBOR la 3 luni a scazut cu aproape un punct, dupa masurile luate de BNR; cu cat se reduce rata la credite?

- In ce mall din sectorul 4 pot face o simulare pentru o refinantare?

Noutati BCE

- Acord intre BCE si BNR pentru supravegherea bancilor

- Banca Centrala Europeana (BCE) explica de ce a majorat dobanda la 2%

- BCE creste dobanda la 2%, dupa ce inflatia a ajuns la 10%

- Dobânda pe termen lung a continuat să scadă in septembrie 2022. Ecartul față de Polonia și Cehia, redus semnificativ

- Rata dobanzii pe termen lung pentru Romania, in crestere la 2,96%

Noutati EBA

- Bancile romanesti detin cele mai multe titluri de stat din Europa

- Guidelines on legislative and non-legislative moratoria on loan repayments applied in the light of the COVID-19 crisis

- The EBA reactivates its Guidelines on legislative and non-legislative moratoria

- EBA publishes 2018 EU-wide stress test results

- EBA launches 2018 EU-wide transparency exercise

Noutati FGDB

- Banii din banci sunt garantati, anunta FGDB

- Depozitele bancare garantate de FGDB au crescut cu 13 miliarde lei

- Depozitele bancare garantate de FGDB reprezinta doua treimi din totalul depozitelor din bancile romanesti

- Peste 80% din depozitele bancare sunt garantate

- Depozitele bancare nu intra in campania electorala

CSALB

- La CSALB poti castiga un litigiu cu banca pe care l-ai pierde in instanta

- Negocierile dintre banci si clienti la CSALB, in crestere cu 30%

- Sondaj: dobanda fixa la credite, considerata mai buna decat cea variabila, desi este mai mare

- CSALB: Romanii cu credite caută soluții pentru reducerea ratelor. Cum raspund bancile

- O firma care a facut un schimb valutar gresit s-a inteles cu banca, prin intermediul CSALB

First Bank

- Ce trebuie sa faca cei care au asigurare la credit emisa de Euroins

- First Bank este reprezentanta Eurobank in Romania: ce se intampla cu creditele Bancpost?

- Clientii First Bank pot face plati prin Google Pay

- First Bank anunta rezultatele financiare din prima jumatate a anului 2021

- First Bank are o noua aplicatie de mobile banking

Noutati FMI

- FMI: criza COVID-19 se transforma in criza economica si financiara in 2020, suntem pregatiti cu 1 trilion (o mie de miliarde) de dolari, pentru a ajuta tarile in dificultate; prioritatea sunt ajutoarele financiare pentru familiile si firmele vulnerabile

- FMI cere BNR sa intareasca politica monetara iar Guvernului sa modifice legea pensiilor

- FMI: majorarea salariilor din sectorul public si legea pensiilor ar trebui reevaluate

- IMF statement of the 2018 Article IV Mission to Romania

- Jaewoo Lee, new IMF mission chief for Romania and Bulgaria

Noutati BERD

- Creditele neperformante (npl) - statistici BERD

- BERD este ingrijorata de investigatia autoritatilor din Republica Moldova la Victoria Bank, subsidiara Bancii Transilvania

- BERD dezvaluie cat a platit pe actiunile Piraeus Bank

- ING Bank si BERD finanteaza parcul logistic CTPark Bucharest

- EBRD hails Moldova banking breakthrough

Noutati Federal Reserve

- Federal Reserve anunta noi masuri extinse pentru combaterea crizei COVID-19, care produce pagube "imense" in Statele Unite si in lume

- Federal Reserve urca dobanda la 2,25%

- Federal Reserve decided to maintain the target range for the federal funds rate at 1-1/2 to 1-3/4 percent

- Federal Reserve majoreaza dobanda de referinta pentru dolar la 1,5% - 1,75%

- Federal Reserve issues FOMC statement

Noutati BEI

- BEI a redus cu 31% sprijinul acordat Romaniei in 2018

- Romania implements SME Initiative: EUR 580 m for Romanian businesses

- European Investment Bank (EIB) is lending EUR 20 million to Agricover Credit IFN

Mobile banking

- Comisioanele BRD pentru MyBRD Mobile, MyBRD Net, My BRD SMS

- Termeni si conditii contractuale ale serviciului You BRD

- Recomandari de securitate ale BRD pentru utilizatorii de internet/mobile banking

- CEC Bank - Ghid utilizare token sub forma de card bancar

- Cinci banci permit platile cu telefonul mobil prin Google Pay

Noutati Comisia Europeana

- Avertismentul Comitetului European pentru risc sistemic (CERS) privind vulnerabilitățile din sistemul financiar al Uniunii

- Cele mai mici preturi din Europa sunt in Romania

- State aid: Commission refers Romania to Court for failure to recover illegal aid worth up to €92 million

- Comisia Europeana publica raportul privind progresele inregistrate de Romania in cadrul mecanismului de cooperare si de verificare (MCV)

- Infringements: Commission refers Greece, Ireland and Romania to the Court of Justice for not implementing anti-money laundering rules

Noutati BVB

- BET AeRO, primul indice pentru piata AeRO, la BVB

- Laptaria cu Caimac s-a listat pe piata AeRO a BVB

- Banca Transilvania plateste un dividend brut pe actiune de 0,17 lei din profitul pe 2018

- Obligatiunile Bancii Transilvania se tranzactioneaza la Bursa de Valori Bucuresti

- Obligatiunile Good Pople SA (FRU21) au debutat pe piata AeRO

Institutul National de Statistica

- Comerțul cu amănuntul, în expansiune la început de an

- România, pe locul 2 în UE la creșterea comerțului cu amănuntul în ianuarie 2024

- Comerțul cu amănuntul, în creștere cu 1,9% pe anul 2023

- Comerțul cu amănuntul, în creștere pe final de an

- Comerțul cu amănuntul, stabilizat la +2% față de anul anterior

Informatii utile asigurari

- Data de la care FGA face plati pentru asigurarile RCA Euroins: 17 mai 2023

- Asigurarea împotriva dezastrelor, valabilă și in caz de faliment

- Asiguratii nu au nevoie de documente de confirmare a cutremurului

- Cum functioneaza o asigurare de viata Metropolitan pentru un credit la Banca Transilvania?

- Care sunt documente necesare pentru dosarul de dauna la Cardif?

ING Bank

- La ING se vor putea face plati instant din decembrie 2022

- Cum evitam tentativele de frauda online?

- Clientii ING Bank trebuie sa-si actualizeze aplicatia Home Bank pana in 20 martie

- Obligatiunile Rockcastle, cel mai mare proprietar de centre comerciale din Europa Centrala si de Est, intermediata de ING Bank

- ING Bank transforma departamentul de responsabilitate sociala intr-unul de sustenabilitate

Ultimele Comentarii

-

Înșelăciune

O să depun plângere când ajung în România sunt mare escroci nu știiu cum am putut crede așa ... detalii

-

Înșelăciune

La fel am pățit și eu și ce credeți după ce am plătit tot felul de taxe amenință ca are ... detalii

-

Refuz de plată la o benzinărie suma de 103 euro

Mi s-au retras de două ori suma de 48 euro și suma de 103 euro suma corectă este de 48 de euro ... detalii

-

nevoia de banci

De ce credeti ca acum nu mai avem nevoie de banci si firme de asigurari? Pentru ca acum avem ... detalii

-

Mda

ACUM nu e nevoie de asa ceva .. acum vreo 20 de ani era nevoie ... ACUM de fapt nu mai e asa multa ... detalii