Agentia de rating Standard&Poors, singura care a inclus Romania in categoria "junk" (BB+), nerecomandata investitorilor, dupa criza din 2008, a mentinut calificativul acordat tarii noastre la BBB-, conform unui comunicat.

Agentia prognozeaza o crestere a PIB-ului Romaniei cu 3,9% in 2019, 3,5% in 2020, 2,9% in 2021 si 2,8% in 2022.

Iata comunicatul Standard&Poors:

Romania Ratings Affirmed At ´BBB-/A-3´; Outlook Stable

30-Aug-2019 16:05 EDT

Overview

We expect Romania´s growth to gradually decelerate next year as external demand and wage inflation subside amid a weakening fiscal impulse.

The country´s twin deficits are widening, but we do not project public and private debt levels will rise meaningfully over the next two years.

However, our base-line macroeconomic scenario depends, on real exchange rates remaining relatively firm, and average growth not dipping below 3% to 2022, as EU funds and other capital inflows continue to spur demand.

We are affirming our ´BBB-/A-3´ ratings on Romania and maintaining a stable outlook.

Rating Action

On Aug. 30, 2019, S&P Global Ratings affirmed its ´BBB-/A-3´ long- and short-term foreign and local currency sovereign credit ratings on Romania. The outlook is stable.

Outlook

The outlook is stable because we expect Romania´s fiscal and external debt will increase only modestly over the coming two years, despite elevated fiscal and external deficits. We also expect the large twin deficits will stabilize at somewhat lower levels as the economy cools and authorities take gradual fiscal steps.

Downside scenario

We could lower the ratings if fiscal and external imbalances persist longer than we currently project, pushing public debt higher than we currently forecast, and leading to an over extension of real wages and the real exchange rate. Under this alternative scenario, Romania´s economy would become more vulnerable to a hard economic landing.

Rating pressure could also come via an erosion of monetary credibility, should Romania fail to contain headline inflation, currently at 4.1%, which is the highest of all new EU member states. The risk of higher inflation could, under some scenarios, increase exchange rate volatility, with potential negative repercussions on public and private sector balance sheets.

Upside scenario

We could raise the rating if Romania´s institutional framework strengthened, translating into more predictable policymaking. Under such a scenario, we anticipate that the government would make headway on budgetary consolidation, putting net general government debt firmly on a downward trajectory.

Rationale

Romania´s comparatively low general government and external debt, its EU membership, and solid recent growth performance support the ratings. Constraints to the ratings include low economic wealth, relatively weak administrative capacity, an unpredictable policy environment, and only average monetary flexibility relative to peers.

As a result of the government´s procyclical and pre-electoral fiscal stance, budgetary and external deficits will likely remain substantial over the next few years. However, we do not forecast the budgetary deficit will exceed 3.4% of GDP in 2020. Given our view that growth will remain solid (albeit lower), and nondebt external inflows will continue, we don´t forecast any major deterioration in public or private debt levels between now and 2023. However, this projection could change if there was either a sharp correction in growth, a much larger fiscal deviation, an exchange rate devaluation, or a combination of the three.

Institutional and economic profile: The post-crisis economic expansion is reaching its peak

Economic growth should remain just below 4% this year before weakening in 2020-2021 due to slowing external demand, easing wage growth, and a more neutral fiscal environment.

Erratic policy execution, low administrative capacity, corruption, and polarization weigh on our institutional assessment, which is nevertheless helped by Romania´s EU membership.

We expect Romania´s consumption-led expansion will continue in 2019, with headline growth of just under 4%, driven by public and private consumption. This follows average wage inflation so far this year of close to 14%. By 2020, however, the growth cycle should reverse, with GDP weakening toward 3.0%-3.5% or potentially lower, as fiscal impetus, real wage growth, and external demand all weaken. The timing of the growth cycle is difficult to project, with the risk being that the cycle declines sooner and more forcefully than we currently forecast.

One of our key assumptions is that the government will tighten the budget to offset planned sizable increases in pension spending in 2020 and 2021, after national elections. We therefore project that the net contribution to GDP growth from fiscal measures in 2020 will be only mildly positive, and essentially zero in 2021.

Romania´s growth dynamics remain constrained by the high net emigration of skilled labor, and weak overall population growth. Structural reforms to address these issues appear to be lacking. High wage growth in recent years has not been accompanied by comparable increases in productivity, which has in part eroded the competitiveness of Romania´s exports

The economic policy environment has stabilized following the government´s revision of Ordinance 114, a series of sectoral taxes including a comprehensive financial-sector balance sheet tax, which in its original construction would have likely born negative consequences for monetary policy effectiveness. Nevertheless, policy coordination among authorities is weak, and fiscal planning has been ad hoc and reactive.

On Aug. 26, 2019, the ALDE party withdrew from the government coalition, leaving the PSD party with a ruling minority. Although the lack of a cohesive opposition lessens the likelihood of early elections, the departure of ALDE from the governing coalition is likely to further handicap policy-making for the remainder of 2019. That said, we consider difficult fiscal decisions, such as curbing overall expenditure and securing fiscal room for the recent pension law, will be left to the next cabinet after the 2020 elections.

Romania´s EU membership is, in our view, an important policy anchor and has been a major deterrent to recent attacks on the independence of the judiciary. To date, proposals to amend justice laws and criminal codes have stopped short of implementation, also in the face of strong domestic opposition.

Flexibility and performance profile: External imbalances are widening due to brisk consumption and expedient fiscal policy

The financing mix of Romania´s current account deficit is shifting, as FDI and capital account flows temper.

We expect the government will maintain its expansionary budgetary stance until the 2020 elections.

Inflationary pressures are building from excess demand and still-strong wage growth.

We estimate that Romania´s fiscal deficit will remain at about 3% of GDP in 2019 on the back of strong nominal GDP growth, the potential for extra dividends from state-owned enterprises, and a likely further slashing of the investment budget.

Budgetary imbalances are building, however, with spending on wages and pensions now surpassing 80% of tax revenue. Adding to the structural challenges is the low tax collection potential in Romania, which is likely to persist despite the government´s actions to step up value-added tax collection. The gap between expected VAT revenues and VAT actually collected is the largest in the EU, according to European Commission data.

Romania is preparing for presidential elections in 2019 and local and parliamentary elections in 2020. With political constituents in election mode, we expect the government deficit will widen slightly to 3.4% of GDP in 2020, partly due to efforts to secure electoral support.

We believe pressure on Romania´s budget will persist through 2022. In July 2019, the government passed pension legislation, which, if implemented according to plan, would have fiscal repercussions in the short term. We estimate that the legislated pension increases would amount to 3.0% of GDP by 2021. We include only part of this estimate in our forecast, however, since we expect the government will use caveats in the pension law that subject effective pension increases to the availability of fiscal funds. Despite this, the resulting short-term political gains could continue to influence fiscal strategy, leading to a shift in budgetary allocations from the capital side to current account spending.

The Romanian government has repeatedly deviated from the medium-term objectives stipulated in the EU Stability and Growth Pact. With fiscal pressures building, we expect deficits to extend to 3.4% of GDP in 2020, which would need to be addressed by the incoming government. We expect that fiscal adjustments will likely involve scrapping some of the pension increases anticipated in the recently introduced pension law. That said, Romania´s higher deficit might prompt the European Commission to open an excessive deficit procedure in 2020, which could facilitate fiscal prudence. Ultimately, the fiscal adjustment will likely result in reduced government consumption and dampen economic growth.

Romania´s current account will likely remain elevated through 2022 as government consumption and domestic demand lead to higher imports. Together with slowing exports, this will result in deficits exceeding 5.0% of GDP on average over 2020-2021. We observe that the current account deficit is increasingly covered by debt-financed inflows, since FDI and capital account flows are tempering.

Moreover, we note a lack of foreign greenfield investments, suggesting that investors might be increasingly hesitant due to the rapid wage growth, lack of infrastructure development, and persisting political and policy uncertainties. For this reason, we expect Romania´s external debt will keep increasing. Given the low starting point, we do not foresee a buildup of material external stock imbalances. We forecast Romania´s external debt net of external public and financial sector assets to be slightly over 40% of current account receipts by 2022.

Romania´s predominantly foreign-owned banking sector remains sound, in our view. The system´s loan-to-deposit ratio declined to about 80% at year-end 2018 from its peak of 137% in 2008. Lending growth has remained positive for the past two years, with loans to households and loans denominated in Romanian leu increasing strongly, although this trend has recently decelerated. Nonperforming loans dropped to less than 5% of total loans by Dec. 31, 2018, down from over 21% at mid-year 2014. Liquidity and solvency ratios remain strong and banks have maintained their profitability despite low interest rates.

The leu´s value is under managed float in an inflation targeting regime, with a target of 2.5%, +/-1 percentage point. We observe that the National Bank of Romania has remained independent, despite political pressure in 2018, and conducted its firm and credible monetary policy. The bank raised rates three times in 2018, by a total of 75 basis points, under efforts to ease inflationary pressures from excess demand and strong wage growth.

We forecast an inflation rate of 4.0% in 2019, which is above the central bank´s target. We believe that the inflationary environment will keep the spotlight on monetary policy, due to the need to firmly anchor inflation expectations. Greater monetary independence is partly inhibited by the relatively high share of system deposits in foreign currencies.

Key Statistics

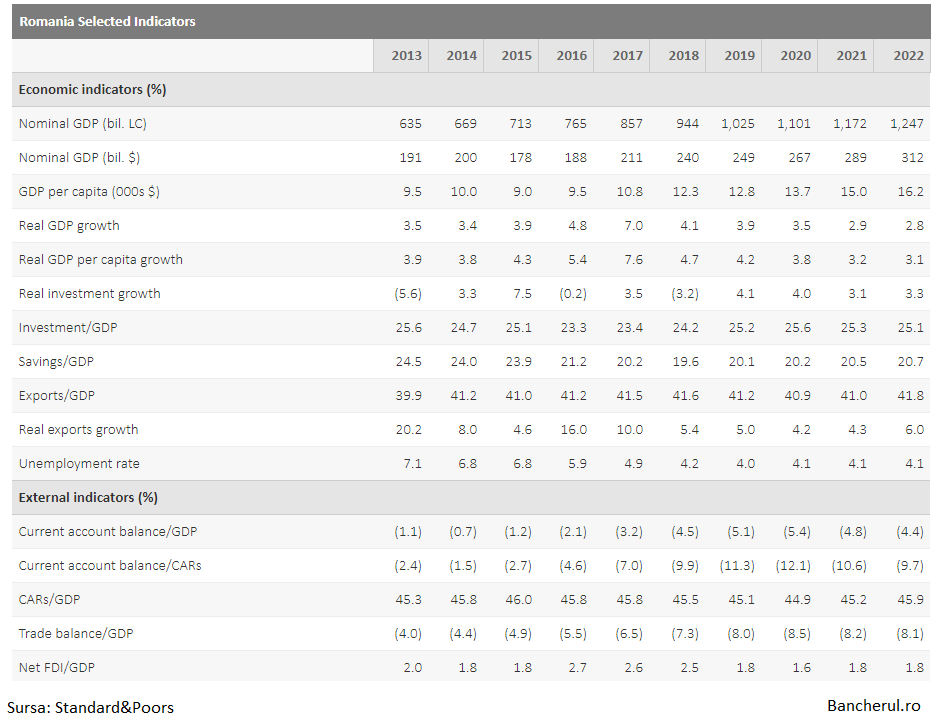

Table 1

Romania Selected Indicators

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Economic indicators (%)

Nominal GDP (bil. LC) 635 669 713 765 857 944 1,025 1,101 1,172 1,247

Nominal GDP (bil. $) 191 200 178 188 211 240 249 267 289 312

GDP per capita (000s $) 9.5 10.0 9.0 9.5 10.8 12.3 12.8 13.7 15.0 16.2

Real GDP growth 3.5 3.4 3.9 4.8 7.0 4.1 3.9 3.5 2.9 2.8

Real GDP per capita growth 3.9 3.8 4.3 5.4 7.6 4.7 4.2 3.8 3.2 3.1

Real investment growth (5.6) 3.3 7.5 (0.2) 3.5 (3.2) 4.1 4.0 3.1 3.3

Investment/GDP 25.6 24.7 25.1 23.3 23.4 24.2 25.2 25.6 25.3 25.1

Savings/GDP 24.5 24.0 23.9 21.2 20.2 19.6 20.1 20.2 20.5 20.7

Exports/GDP 39.9 41.2 41.0 41.2 41.5 41.6 41.2 40.9 41.0 41.8

Real exports growth 20.2 8.0 4.6 16.0 10.0 5.4 5.0 4.2 4.3 6.0

Unemployment rate 7.1 6.8 6.8 5.9 4.9 4.2 4.0 4.1 4.1 4.1

External indicators (%)

Current account balance/GDP (1.1) (0.7) (1.2) (2.1) (3.2) (4.5) (5.1) (5.4) (4.8) (4.4)

Current account balance/CARs (2.4) (1.5) (2.7) (4.6) (7.0) (9.9) (11.3) (12.1) (10.6) (9.7)

CARs/GDP 45.3 45.8 46.0 45.8 45.8 45.5 45.1 44.9 45.2 45.9

Trade balance/GDP (4.0) (4.4) (4.9) (5.5) (6.5) (7.3) (8.0) (8.5) (8.2) (8.1)

Net FDI/GDP 2.0 1.8 1.8 2.7 2.6 2.5 1.8 1.6 1.8 1.8

Net portfolio equity inflow/GDP 0.6 0.3 0.1 (0.3) (0.1) (0.1) (0.1) (0.1) (0.1) (0.1)

Gross external financing needs/CARs plus usable reserves 103.6 99.7 95.6 97.8 96.4 98.3 100.4 102.1 103.9 105.0

Narrow net external debt/CARs 64.1 48.5 40.1 29.0 30.9 32.2 34.1 37.3 39.0 40.2

Narrow net external debt/CAPs 62.6 47.8 39.0 27.7 28.9 29.3 30.7 33.3 35.3 36.7

Net external liabilities/CARs 141.8 113.5 114.3 100.8 109.0 104.3 107.5 107.3 106.7 104.5

Net external liabilities/CAPs 138.5 111.9 111.3 96.4 101.9 94.9 96.6 95.7 96.4 95.3

Short-term external debt by remaining maturity/CARs 57.1 51.5 43.4 37.1 29.3 28.5 26.7 25.4 24.3 23.8

Usable reserves/CAPs (months) 6.3 6.3 6.2 5.1 4.6 4.5 4.0 3.7 3.2 3.0

Usable reserves (mil. $) 48,818 43,164 38,705 39,959 44,450 42,132 41,619 39,023 38,861 39,180

Fiscal indicators (general government; %)

Balance/GDP (2.2) (1.3) (0.7) (2.7) (2.7) (3.0) (3.0) (3.4) (3.0) (3.0)

Change in net debt/GDP 2.0 1.9 1.5 0.3 2.4 3.4 3.0 3.4 3.0 3.0

Primary balance/GDP (0.4) 0.4 0.9 (1.2) (1.4) (1.8) (1.7) (2.1) (1.6) (1.6)

Revenue/GDP 33.3 34.1 35.4 31.8 30.9 32.0 32.0 32.5 33.0 33.0

Expenditures/GDP 35.4 35.3 36.1 34.5 33.6 35.0 35.0 35.9 36.0 36.0

Interest/revenues 5.3 4.8 4.6 4.7 4.1 3.7 4.0 4.0 4.1 4.2

Debt/GDP 37.6 39.2 37.8 37.3 35.2 35.0 35.2 36.2 37.0 37.7

Debt/revenues 113.0 115.1 106.6 117.3 113.6 109.2 110.0 111.3 112.0 114.4

Net debt/GDP 32.0 32.3 31.7 29.9 29.1 29.8 30.4 31.7 32.8 33.8

Liquid assets/GDP 5.6 6.9 6.0 7.4 6.1 5.2 4.8 4.4 4.2 3.9

Monetary indicators (%)

CPI growth 3.2 1.4 (0.4) (1.1) 1.1 4.1 4.0 3.5 3.2 3.2

GDP deflator growth 3.4 1.7 2.6 2.5 4.7 5.9 4.5 3.7 3.5 3.5

Exchange rate, year-end (LC/$) 3.26 3.69 4.15 4.30 3.89 4.07 4.15 4.10 4.00 4.00

Banks´ claims on resident non-gov´t sector growth (3.2) (3.0) 3.1 1.1 5.6 7.9 5.0 4.7 4.3 4.3

Banks´ claims on resident non-gov´t sector/GDP 34.7 32.0 31.0 29.2 27.5 26.9 26.0 25.4 24.9 24.4

Foreign currency share of claims by banks on residents 37.0 33.7 29.3 25.4 22.0 20.8 31.3 31.3 31.3 31.3

Foreign currency share of residents´ bank deposits 34.1 33.1 32.4 31.3 31.8 33.2 31.0 31.0 31.0 31.0

Real effective exchange rate growth 4.7 0.7 (3.4) (1.8) (1.5) 2.8 N/A N/A N/A N/A

Sources: Eurostat (economic indicators), Bank of Romania and IMF (monetary indicators), Eurostat (fiscal and debt indicators), and Bank of Romania (external indicators)

Adjustments: No data adjustments applied

Definitions: Savings is defined as investment plus the current account surplus (deficit). Investment is defined as expenditure on capital goods, including plant, equipment, and housing, plus the change in inventories. Banks are other depository corporations other than the central bank, whose liabilities are included in the national definition of broad money. Gross external financing needs are defined as current account payments plus short-term external debt at the end of the prior year plus nonresident deposits at the end of the prior year plus long-term external debt maturing within the year. Narrow net external debt is defined as the stock of foreign and local currency public- and private- sector borrowings from nonresidents minus official reserves minus public-sector liquid assets held by nonresidents minus financial-sector loans to, deposits with, or investments in nonresident entities. A negative number indicates net external lending. N/A--Not applicable. LC--Local currency. CARs--Current account receipts. FDI--Foreign direct investment. CAPs--Current account payments. e--Estimate. f--Forecast. The data and ratios above result from S&P Global Ratings´ own calculations, drawing on national as well as international sources, reflecting S&P Global Ratings´ independent view on the timeliness, coverage, accuracy, credibility, and usability of available information.

Ratings Score Snapshot

Table 2

Romania Ratings Score Snapshot

Key rating factors Score Explanation

Institutional assessment 4 Policy choices over the past few years have led to very procyclical fiscal policies and hence weakened support for sustainable public finances. The country suffers from weak transparency owing to political interference undermining institutional independence.

Economic assessment 4 Based on GDP per capita ($) as per the Selected Indicators in Table 1.

External assessment 3 The Romanian leu is neither a reserve nor an actively traded currency. Based on narrow net external debt and gross external financing needs as per the Selected Indicators in Table 1.

Fiscal assessment: flexibility and performance 4 Based on the change in net general government debt (% of GDP) as per Selected Indicators in Table 1

Fiscal assessment: debt burden 3 Based on net general government debt (% of GDP) and general government interest expenditures (% of general government revenues) as per Selected Indicators in Table 1.

Bank exposure to government stands at 21% as of March 2019 and over 40% of government debt denominated in foreign currency.

Monetary assessment 3 Managed float. Since 2005, the National Bank of Romania has targeted inflation but hasn´t moved to a full-inflation targeting framework. It therefore intervenes in foreign exchange markets.

The central bank enjoys operational independence with market based instruments.

Indicative rating bbb- As per Table 1 of "Sovereign Rating Methodology."

Notches of supplemental adjustments and flexibility 0

Final rating

Foreign currency BBB-

Notches of uplift 0 Default risks do not apply differently to foreign- and local-currency debt

Local currency BBB-

S&P Global Ratings´ analysis of sovereign creditworthiness rests on its assessment and scoring of five key rating factors: (i) institutional assessment; (ii) economic assessment; (iii) external assessment; (iv) the average of fiscal flexibility and performance, and debt burden; and (v) monetary assessment. Each of the factors is assessed on a continuum spanning from 1 (strongest) to 6 (weakest). S&P Global Ratings´ "Sovereign Rating Methodology," published on Dec. 18, 2017, details how we derive and combine the scores and then derive the sovereign foreign currency rating. In accordance with S&P Global Ratings´ sovereign ratings methodology, a change in score does not in all cases lead to a change in the rating, nor is a change in the rating necessarily predicated on changes in one or more of the scores. In determining the final rating the committee can make use of the flexibility afforded by §15 and §§126-128 of the rating methodology.

Ratings List

Ratings Affirmed

Romania

Sovereign Credit Rating BBB-/Stable/A-3

Transfer & Convertibility Assessment A-

Senior Unsecured BBB-

Short-Term Debt A-3