“Poor governance framework”. Aceasta expresie, care catalogheaza cadrul de guvernare ca fiind slab, poarta principala vina pentru faptul ca ratingul Romaniei (BBB-) ramane in continuare neschimbat de catre agentia americana Standard&Poors.

Aceasta a reconfimat, in 9 octombrie, ratingul Romaniei, cu perspectiva stabila, cu urmatoarele explicatii: “Ratingul este sustinut de datoria externa si cea publica moderate, in contextul unei cresteri economice relativ robusta. Ratingurile sunt afectate de cadrul slab de guvernare, in ciuda recentelor eforturi de reducere a coruptiei, de nivelul inca redus al PIB-ului pe locuitor (9.000 de dolari) in comparatia cu tarile vecine, precum si nivelul inca ridicat, desi in scadere, a datoriei sectorului privat, majoritatea in valuta, ceea ce poate afecta transmiterea politicii monetare.

Adoptarea noului Cod fiscal, cu masurile prociclice de relaxare fiscala, precum reducerea TVA-ului, va anula o parte din consolidarea fiscala obtinuta de autoritatile romane incepand in 2009, insotita de o crestere de 4% a PIB-ului in perioada 2009-2014, considera agentia de rating.

Aceasta mentioneaza ca ar putea majora ratingul Romaniei daca va continua consolidarea bugetara si daca vor fi implementate cu succes restructurarile companiilor de stat, avand ca efect scaderea datoriei publice, la care sa se adauge si o reducere a vulnerabilitatii sectorului privat (banci) fata de fluctuatiile de curs valutar.

Pe de alta parte, mentioneaza Standard&Poors, ratingul ar putea fi scazut in urmatoarele situatii:

- daca schimbarile de politici guvernamentale ar putea duce la cresterea deficitelor si datoriei publice semnificativ peste nivelul asteptat;

- daca reapar dezechilibrele externe ale Romaniei;

- daca scade stabilitatea sistemului financiar.

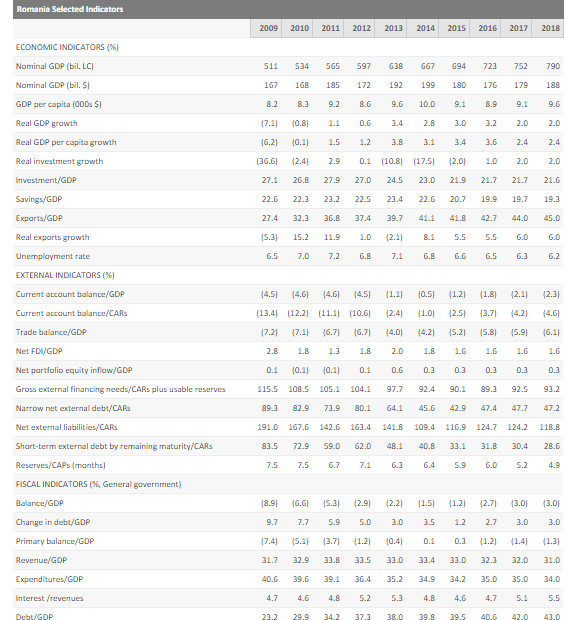

Agentia de rating prognozeaza o crestere a datoriei publice la 43% din PIB in 2018, mai mult decat precedenta prognoza, de 41% din PIB.

Desi guvernul se va incadra in acest an in tinta de deficit bugetar, datorita incasarilor peste asteptari si a cheltuielilor reduse, acesta va ajunge la 3% in 2017.

Standard&Poors anticipeaza insa ca guvenul va adopta masuri populiste inaintea alegerilor de anul viitor si in contextul acuzatiilor de coruptie la adresa premierului Victor Ponta.

Comunicatul agentiei de rating Standard&Poors:

Romania 'BBB-/A-3' Ratings Affirmed; Outlook Stable (09-Oct-2015)

OVERVIEW

We expect the Romanian economy to grow by 2.6% on average from 2015-2018, with domestic demand contributing a greater role.

While the changes in the fiscal code are likely to widen the fiscal deficit, we do not expect general government indebtedness to be significantly affected.

We are therefore affirming our 'BBB-/A-3' ratings on Romania.

The stable outlook balances the likelihood of risks to fiscal consolidation against Romania's generally robust growth prospects.

RATING ACTION

On Oct. 9, 2015, Standard & Poor's Ratings Services affirmed its 'BBB-/A-3' long- and short-term foreign and local currency sovereign credit ratings on Romania.

The outlook is stable.

RATIONALE

The ratings are supported by Romania's moderate external and fiscal indebtedness amid relatively firm growth prospects.

The ratings are constrained by the poor governance framework, despite recent efforts to reduce corruption; low GDP per capita relative to peers (estimated at $9,000 in 2015); and still-high--though declining--private-sector debt, denominated in foreign currency, which can restrict the effective transmission of monetary policy.

A strong procyclical fiscal impulse--most visibly manifest in value-added tax (VAT) cuts in food products and hikes in minimum wages--has benefitted private consumption, as have falling oil prices, rising incomes, and employment.

Further cuts in indirect taxes, together with a host of other fiscal measures, are likely to support Romania's cyclical recovery in 2016 and 2017.

We therefore expect real GDP to grow by 3% in 2015 and at an average rate of 2.6% between 2015 and 2018.

We note that while the current fiscal stance has been supportive to consumption growth, we expect investment in 2015 will still be about a third below its precrisis high.

Risks to our growth forecast include a continued low rate of absorption of EU funds, low public investment, an uncertain external environment amplified by geopolitical risks, or lower-than-anticipated inflows of foreign direct investment (FDI).

A weaker-than-projected recovery of credit growth to the private sector by Romania's predominantly foreign-owned banks could constitute an additional risk, as could the possibility of wages outpacing productivity improvements, leading to a loss of external competitiveness.

Since 2009, Romanian policymakers have been consolidating government finances through the imposition of tough procyclical expenditure constraints, aided by

average nominal GDP growth of 4% over 2009-2014.

We view the changes to the fiscal code, in the form of amendments passed by parliament in June 2015, as

rolling back some of those gains.

Adopted measures include a phased cut in the standard VAT rate to 19% from the current 24% in 2017, tax exemptions, the reduction in the tax on dividends, changes in social contributions, and cuts in excise duties.

While we think the government is likely to outperform its fiscal target in 2015 following higher-than-anticipated revenue intake and constrained capital expenditure, we expect a widening of the general government fiscal deficit toward 3% in 2017.

While our expectation is based on a continued recovery in domestic demand aiding revenue collection, thereby

absorbing some revenue losses, we also anticipate further fiscal loosening in the run-up to the parliamentary elections in 2016.

The proposed hikes in public wages are an example of such a downside risk.

Indeed, the electoral calendar and ongoing events in Romania´s political sphere--such as the trial of Prime Minister Victor Ponta on corruption charges--could prompt a further spate of populist measures.

With our revised deficit forecast, we now project higher government indebtedness, with general government debt peaking at 43% of GDP in 2018, versus our earlier projection of a peak in the debt-to-GDP ratio at 41% in

2017.

Net debt will remain lower than general government debt, owing to government deposits and fiscal reserves, which we project will remain above 5% of GDP across our forecast horizon to 2018.

Just over 50% of gross general government debt is denominated in foreign currency, predominantly euros, indicating some vulnerability to adverse exchange-rate movements.

Romania's external finances have rebalanced substantially from pre-2009 levels--on both stock and flow metrics--led by banking sector deleveraging and an adjustment of the current account deficit toward balance.

We expect the current account deficit will widen slightly over 2015-2018, reflecting higher domestic demand.

However, an improvement in energy efficiency and gradually increasing value-add in some pockets of Romania's expanding export sector are likely to prevent external imbalances from re-emerging.

We anticipate that, from 2017, Romania's current account deficit will be overfunded by surpluses on the capital account and the financial account.

We think the latter will benefit from continuing FDI inflows, public- and private-sector borrowings, and slowing net outflows from the financial sector as domestic lending opportunities increase.

We expect deflation, prompted by the June cut in the VAT rate on foodstuffs, to persist until the middle of next year as further tax cuts are implemented in early 2016.

Although Romania enjoys a managed-float exchange rate regime, monetary policy remains constrained by the relatively high share of foreign currency loans contracted by the private sector.

That said, we expect euroization to continue to decline, helped by National Bank of Romania policies, such as prudential measures to discourage foreign currency lending

to households, narrowing the interest rate differential between loans denominated in Romanian leu and those denominated in foreign currency, and maintaining higher reserve requirements for liabilities in foreign currency

relative to liabilities denominated in leu.

Because the majority of foreign currency loans are denominated in euros, the Romanian private sector has been left relatively unscathed by the 13% depreciation of the Romanian leu against the dollar since October last year.

We also note that given the relatively low proportion of Swiss franc lending compared with some regional peers, such as Poland, there is less pressure on Romanian policymakers to adopt a centralized approach for unhedged Swiss franc borrowers who have been adversely affected by the franc's recent appreciation.

OUTLOOK

The stable outlook balances the likelihood of risks to fiscal consolidation against Romania's relatively robust growth prospects.

We could raise the ratings if Romania's budgetary consolidation continues and public enterprise restructuring is implemented successfully, leading to a reduction in net government debt, matched by a further decrease in

private-sector vulnerability to exchange rate fluctuations.

We could lower the ratings on Romania if any of the following scenarios materialize:

- We think policy reversals could cause general government deficits and indebtedness to increase significantly more than we currently expect,

- Romania's external imbalances re-emerge, or

- The stability of Romania's financial sector weakens.